THE TACTICAL ADVISOR

BCA’s Tactical Advisor newsletter is emailed to clients throughout the quarter. Each issue includes information on active management – to help build an understanding of our investment approach – as well as articles on financial issues we hope you will find of interest. To receive email copies of the newsletter, please register through the signup form in the footer. Remember, all investing carries the potential for loss as well as gain. Past performance is not indicative of future returns.

Brian R. Carruthers, CFP®, CMTSM

Fourth Quarter 2024 Articles

Risk On Risk Off Investment Strategies

Active investment strategies ask how do we reduce the risk of crippling market losses and keep clients invested for the long run? Risk On, Risk Off is one of the tools to do so. Risk On is taking greater risks in pursuit of higher returns. Risk Off is when we prioritize capital preservation and avoid higher risk investments.

A Salute to the U.S. Constitution

The ability to achieve financial security, to own property, to start a business and benefit from the protection of the law is a direct benefit of the Constitution of the United States, the most amazing document in our country’s history.

Stock Markets Evolve and Change

One of the more misleading ways to analyze the U.S. stock market is to look at the past 100 to 200 years and anticipate that market returns will in some fashion reflect the past. But today’s stock market is very different than the stock market in 1990, 2000, or even 2020, to say nothing of 50 years ago.

Bored? Retiring and Not Sure What To Do?

Take Advantage of the Lifetime Learning Credit

The federal Lifetime Learning Credit is a tax break available for qualifying tuition and fee payments you make to a post-secondary school (after high school).

When It’s Time to Spend Down Your Assets

After a lifetime of saving and investing, it’s hard to spend down assets. It took a lot of work to accumulate your net worth and whittling it down can be disturbing. Then there’s the worry of running out of money or encountering unexpected expenses that take a chunk out of your financial security net. At the same time, this is your opportunity to finally relax and enjoy new activities. It’s time for some planning.

Third Quarter 2024 Articles

Balancing Willingness to Take Risk and Ability to Take Risk

Most people accept the fact that higher return requires taking greater risk, but all too many assume that higher risk assures higher returns. That’s not the way it works. Risk is the possibility that you will lose money, sometimes all your money. In building portfolios for clients, one of our questions is how much risk you are comfortable with, i.e. if your portfolio loses 10% will you be looking for another advisor? What about 20%, 30% or more?

Cautious Optimists Make the Best Investors

To be a good investor, it helps to be an optimist. Otherwise, bad news and potential problems would overwhelm your ability to make investment decisions. The bears can always make a good argument about why the market is approaching meltdown because there’s always something that can go wrong. But there’s also a lot of good news.

Planning Ahead … If the 2017 Tax Cuts and Jobs Act (TCJA) Sunsets

Remember the Trump tax cuts that took effect in 2018? Without Congressional action, the Tax Cuts and Jobs Act (TCJA) of 2017 is scheduled to sunset after December 31, 2025. Regardless of who the next president will be, the odds that the TCJA tax cuts will be extended are not looking good. That leaves many Americans with just 18 months to lock in tax savings from the TCJA before the start of 2026. Depending upon how much you may face in future taxes, the savings could be extensive.

Owning Gold is Gaining Popularity

When you can buy gold along with your groceries at Costco, there’s clearly increased desirability to owning gold. But before you get too carried away with your gold stash, there are a few things you need to understand.

T+1 Settlement Took Effect on May 28

As of Tuesday, May 28, 2024, a SEC new rule took effect requiring most securities transactions to “settle” in one day. Settlement is when stock is transferred from the seller’s portfolio to the buyer, and payment is deducted from the buyer’s account and transferred to the seller.

Second Quarter 2024 Articles

The Rest of the Story

Less attention paid to news and social media may pay off when it comes to investing. While reading a wide variety of news sources and trying to learn as much as you can about the economy and new trends is of value to every investor, making investment decisions based on the news media is questionable. Before you jump on the media bandwagon, it helps to know “the rest of the story.”

The Importance of Living Within Your Means

Investors had an exhilarating ride during the fourth quarter of 2023 and the opening of 2024, and many are feeling considerably richer and more financially secure. But before you get too carried away with your new wealth and decide it’s time live large, take a moment to recall Warren Buffet’s advice, “Remember that the stock market is a manic depressive.”

Developing Multiple Sources of Retirement Income

By having alternative sources of income that are taxed differently, retirees can tap into different sources of funds over the span of their retirement to minimize taxes, reduce the impact of down markets, and have more after-tax funds to spend.

The goal of developing alternative sources of retirement income is to be able to modify income sources in response to changing circumstances and market returns to minimize taxes and optimize after-tax income.

Longevity Changes the Game

Human longevity forecasts envision a growing population of 120-year-olds by 2050, 26 short years away. The maximum human lifespan could top 130 by 2100 according to researchers at the University of Washington. On the one hand, the prospect of a longer life is exciting. Think of what you could do with all those years. On the other hand, it is terrifying. Extending the average life span by 30+ years will mean a host of social and financial changes.

First Quarter 2024 Articles

New Year Checklist – Essential Documents

The start of a new year is a good time to review your essential documents to make certain they are up-to-date and reflect your current wishes. It’s also a good idea to make sure you have the following documents in the event of a health issue or accident.

The Confidence Factor – One of the Uncertainties of Investing

Investing is a relatively simple concept. Put your money to work, so that someday you won’t have to work. For most investors, that comes down to:

- Purchase fractional ownership in a business by owning the stock of good companies and sharing their future increase in value as well as payouts to shareholders.

- Loan money to good companies (or government entities) that will repay their debts and allowing you to build net worth through interest payments or speculation on the future direction of interest rates.

There’s lots of good advice on how to pick the right companies and when to loan money. But at times, even the best investment plan goes awry. It’s times like these that it helps to recall Warren Buffett’s quote, “Remember that the stock market is a manic depressive.”

Reality Check from Charlie Munger

Charles T. Munger, vice chairman of Berkshire Hathaway and Warren Buffett’s closest associate, died November 28, 2023, at age 99. A remarkable man, who lived a remarkable life, Charlie left behind advice that we have tried hard to take to heart. Shared in this article are thoughts from Charlie Munger well worth remembering.

Inflation Adjustments from the IRS Affect Retirement Accounts, Estate Tax Exemptions

While the rate of inflation may be moderating, it is still causing multiple changes in everything from Social Security and benefit programs to retirement plans, income tax brackets and estate tax exemptions. Effective 2024, the contribution limit is $7,000, with an annual $1,000 catch up contribution for individuals over 55. This article highlights changes to retirement plan contributions from IRAs and 401(k) plans to SIMPLE IRAs.

For individuals with large estates who fully expect to live beyond 2025, it is possible to take advantage of the higher gift and estate tax exclusion in effect through 2025 and not be adversely impacted after 2025.

Raising Money Smart Teens

Today’s kids are growing up in a very different financial world than their parents. They may never use a checkbook, rarely handle cash, and face more ways to get in trouble financially than earlier generations ever imagined. While it would be nice to think that teens are taught money smarts at school, the truth is you had better be prepared to share that knowledge at home.

Fourth Quarter 2023 Articles

When “Missing the Best” Doesn’t Matter

Whenever individual investors begin getting nervous about staying invested in equities, it seems the media trots out one of the oldest arguments against active management – what if you miss the best days of the market? One of the latest such arguments against using active management taps into a 2021 study by Bank of America on missing the best and worst days of the market. There’s just a few problems…

Volatility Increases in Uncertain Markets

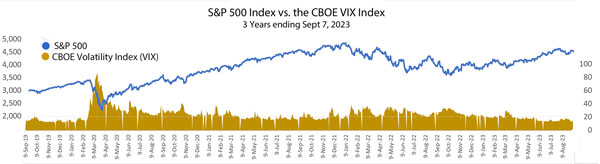

One of the more useful tools for measuring investor uncertainty is the Chicago Board of Options Exchange VIX index. In declining markets, volatility tends to increase as shown by the VIX index versus the S&P 500 over the past three years.

Threats to Your Financial Security Continue to Escalate

It has never been more important to be wary of any unfamiliar contacts by email, text, phone, mail and social media inquiring about your financial accounts. The world is now four months into what may well be the largest digital data theft ever – the MoveIt data breach. As of late August, up to 600 organizations have been identified as victims with the loss of information impacting more than 40 million customers.

Does Your State Owe You Money?

Is there a chance you have misplaced money by forgetting about an old account or a safe deposit box? Did you have funds in a failed bank and have given up trying to reclaim them? Or, perhaps more likely, are you an executor for a deceased person and wondering if they had lost track of a bank account, certificate of deposit, investment account, or safe deposit box? You may be able to reclaim those funds.

Catch-up Contributions to 401(k) Plans Continue to Be Tax Deductible in 2024 and 2025

Good news for age 50-and-over participants in 401(k), 403(b) or governmental 457(b) plans who make catch-up contributions.

Section 603 of the Secure 2.0 Act, enacted in December 2022, required employees who participate in and whose prior-year Social Security wages exceeded $145,000, to make after-tax catch-up contributions to a Roth account starting in 2024. This past August, the Internal Revenue Service granted an administrative transition period that extends until 2026 to the new requirement that any catch-up contributions made by higher income participants in 401(k) and similar retirement plans must be designated as after-tax Roth contributions.

Stop Procrastinating and Take Action

It’s always easy to second guess decisions we should have made that would have left us wealthier today. We should have bought that empty lot, Uncle Joe’s gold coins, a rental property for the kids during college, Microsoft or Apple stock in the 1980s, and so much more.

All too often procrastination played a role in our failure to act. If procrastination is undercutting your ability to build financial security, talk with your financial advisor and put together a plan to overcome your hesitations. Your future could well depend upon doing so.

Third Quarter 2023 Articles

60/40 Portfolio Nears the Three-Quarter Century Mark

Is it time to retire the 60/40 portfolio? The 60/40 portfolio, consisting of 60% equities and 40% bonds/fixed income, may be the most common financial recommendation individual investors encounter. It traces its origins to 1952 when economist Harry Markowitz published his Efficient Market investment model that became known as Modern Portfolio Theory.

Trickle Down Effect of Higher Interest Rates

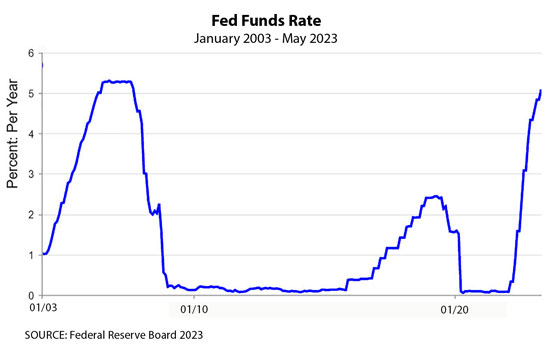

Starting in February of 2022, the Federal Reserve began increasing the Federal Funds Rate to bring inflation under control. Through May 2023, rates rose faster than in previous any cycle. In the process, the Fed brought back to the spotlight a risk many investors had disregarded after over a decade of low interest rates – interest rate risk. 2022 was the worst year on record for bonds, according to Edward McQuarrie, an investment historian and professor emeritus at Santa Clara University.

A Salute to William O’Neil

“I never met anyone, or heard of anyone, or read of anyone who was successful who was a pessimist. You have to be positive, or you’ll never get anywhere.”

William O’Neil – 1933-2023

William O’Neil, founder of Investor’s Business Daily, died Sunday, May 28th at the age of 90. O’Neil was remarkable not only for his rise from poverty growing up in the Dust Bowl of Oklahoma to investing success, but for his focus on helping individuals invest successfully in stocks.

Tax Reduction or Tax Evasion?

Looking for a way to eliminate ordinary income and/or capital gain taxes on the sale of property?

The IRS is warning taxpayers that despite what promoters may say, misusing Charitable Remainder Annuity Trusts is not the way to do so. The IRS is cracking down on abusive arrangements involving Charitable Remainder Annuity Trusts (CRATs) promoted as a means eliminating taxes on donations and receiving tax free income from the Trust.

Retirement Planning Without the Fear Factor

When it comes to retirement planning, much of the advice you will encounter has two big flaws:

- The belief that focusing on the fear that you have not saved enough and will run out of money before you run out of life will motivate you to save more.

- One-size fits all rules.

Retirement will always have its uncertainties, but if you start thinking early about what you want from retirement, testing your ideas, and focusing on what you really want to do with all those years, you will find it a lot easier to be motivated to save the money you need. Focusing on positives rather than negatives changes the game.

Second Quarter 2023 Articles

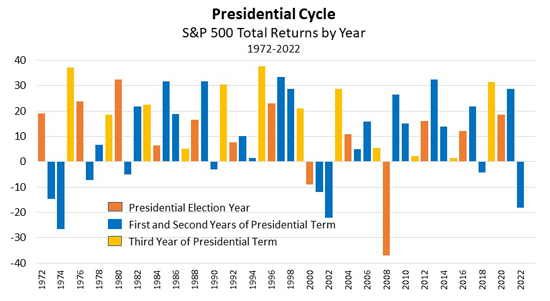

Does the Presidential Cycle Mean an Up Market for 2023?

The Presidential cycle is a curious, but remarkably persistent trend. The stock market has not closed down in the third year of a president’s term since 1939. Another trend favoring good performance in 2023 is the rarity of back-to-back down markets.

The IRS May Consider You a Small Business

The American Rescue Plan of 2021 set out to increase income reporting compliance and tax revenue by changing the 1099-K reporting standard for third-party settlement organizations (TPSOs) from $20,000 or more than 200 transactions per year to $600 in transactions. If you actively use settlement services for total transactions in excess of $600 a year, congratulations, you may be a small business to the IRS.

The Details Matter – SECURE 2.0 Act

July and August brought good news on the inflation front with a drop from a 9.1% annual increase in the Consumer Price Index (CPI) recorded in June to 8.5% in July and 8.3% in August. But the end of inflation still has a rocky road ahead.

Do You Trust Your Phone a Little Too Much?

July and August brought good news on the inflation front with a drop from a 9.1% annual increase in the Consumer Price Index (CPI) recorded in June to 8.5% in July and 8.3% in August. But the end of inflation still has a rocky road ahead.

Preventing Fraud Can Save You from Financial Disaster

There has been a tremendous surge in financial fraud, so once again we are cautioning clients, family and friends that they must take steps to protect their financial assets.

First Quarter 2023 Articles

Complications Abound for 2023 Market Outlook

After a crazy, volatile year end for financial markets in 2022, market forecasts for 2023 are expected to touch every extreme. The problem is that it really is different this time. Monetary policy since 2020 has created extremes that we’ve never seen before.

Beware of Promissory Note Fraud

The Securities and Exchange Commission (SEC) and North American Securities Administrators Association (NASAA) have named promissory note fraud as one of the greatest threats to investors in 2023. Invest in a fraudulent promissory note, and there is NO way to recover your money.

Retirement Plan Contribution Limits for 2022 and 2023

The inflation rate in 2022 has substantially increased employee contribution limits for retirement plans in 2023. New limits for 2023 contributions as well as 2022 contribution limits, which need to be made before April 15, are shown in this article.

Rethinking Retirement Accounts

There are disadvantages to ending up with excessive balances in taxable retirement accounts from the potential for higher taxes to their value as an inheritance to your beneficiaries. It’s never too early to rethink your investment strategy to blend asset location and tax impacts into an approach that makes the most sense for your financial situation and your future goals.

Giving Away Money Needs to Start with a Plan

One of the more pleasant surprises in life is to discover you have more money than you will be able to spend, and you can afford to make financial gifts to family, friends, causes, and charities. There are two tax realities that make gifting over the next three years more attractive. But before you do so, you need to talk with your financial and tax advisors about the pros and cons of gifts and whether you risk running out of money you might need later.

Fourth Quarter 2022 Articles

The Good News, Bad News of Inflation

July and August brought good news on the inflation front with a drop from a 9.1% annual increase in the Consumer Price Index (CPI) recorded in June to 8.5% in July and 8.3% in August. But the end of inflation still has a rocky road ahead.

Why Are Forecasts So Often Wrong?

The nature of humanity is to seek control over our lives. We try to impose patterns on life to help us predict the future, even when those patterns may have little reality. We look to science for ways to control the world around us.

But it often seems that the more humanity seeks to control and understand the world, the weather, the markets, the behavior of a crowd, or even the tipping point of a social or physical change, the more unpredictable events become.

Watch Out for the Tropes!

Have you been told recently that your comment is just a trope? If not, the word could be turning up any day now, likely as a putdown. A trope twists language to create a meaning beyond the literal. While trope is closely related to “metaphor”, if someone tells you that is just a trope, they may mean it is just a common or overused theme or device.

Simple Techniques to Avoid Late Fees and Penalties

Back in July, the Wall Street Journal reported a curious trend…people are forgetting to pay bills.

If you find yourself forgetting payments, there could be a number of perfectly normal reasons. The good news is that there are also a number of relatively simple changes you can put in place to make certain you don’t incur late fees or penalties because time got away from you.

Preparing for the Inevitable

Ideally, we will all grow old, given the alternative is dying too young. But preparing for the day we will be old is hard. In fact, most people prefer to avoid thinking about aging until they are face-to-face with reality, which can be too late if they need long-term care and are unprepared financially for the cost.

According to the Center for Retirement Research at Boston College, among individuals age 65 and onward:

- A fortunate 20% will need NO long-term care support

- 25% are likely to experience a severe need for long-term care

- 22% will have low long-term care needs

- 33% will have moderate long-term care needs

Third Quarter 2022 Articles

Welcome to Unintended Consequences and Interesting Times

The Law of Unintended Consequences is the premise that actions of people—and especially of government—always have effects that are unanticipated or unintended. Each and every purposeful act leads to results, which are unintended and unforeseen, apart from those which were intended. The Law of Unintended Consequences seems particularly potent these days.

Preparing for Evacuation

2021 saw the evacuation of more than a million people from their homes in the U.S. alone in the face of natural and man-made disasters. If an evacuation order happens in your neighborhood, will you be prepared to evacuate with some of the most important documents you need if the worst happens?

The Next Big Thing – Energy Innovation?

The search for clean energy alternatives that overcome the disadvantage of current technologies may well be the next big thing in investing. Because without solving the energy problem, we can’t continually add on demands to our energy grid for electronics, automation and so much more.

Six Tools of Persuasion

What makes us more likely to respond to a request? In 1984, Robert Cialdini published six tendencies of human behavior that tend to result in a positive response. Those same six are still very true today. Can you identify when these tools are beings used to manipulate your decisions?

Don’t Forget to Put the Power of the List to Work!

Second Quarter 2022 Articles

Coping with Market Downturns

Just when it looked like the Covid pandemic was falling behind us and life was getting back to normal, Russia invaded Ukraine and every hope for a calm investment year went out the window.

With unknown repercussions of the Ukrainian invasion and the long-term impacts of an unprecedented array of financial sanctions against Russia looming over the market, joining the threats of continuing inflation and supply shortages, and the potential for further Covid disruptions, it isn’t surprising many investors and media commentators are beginning to sound more than a bit panicked. What’s next? Recession? Bear market? A European war? And what does it mean for your investment portfolio?

Put the News on Time Out

Studies of viewers over the last two pandemic years have shown that watching news of physical and social disasters leads to a form of post-traumatic stress disorder (PTSD), complete with symptoms of depression, anxiety, stress reactions and substance abuse.

Overcoming Retirement Account Investing Hesitations

The more economic uncertainty, the more hesitant we find clients are to lock up funds in a retirement account. But retirement accounts are an important part of building retirement security, particularly with Social Security forecast to be in the red by 2025. For investors concerned that they may need access to their retirement funds prior to age 59½, it helps to know that several exemptions exist that allow early withdrawals without a 10% penalty.

Asset Location Is an Important Tool to Reduce Taxes

Asset location is a tool that investors can use to strive to minimize gains lost to taxes. Asset location refers to the account structure in which your assets are held and the type of assets you own.

First Quarter 2022 Articles

Greenwashing Among Risks of ESG Investing

Within every investing fad and hot stock category, fraud proliferates for a very simple reason, “That’s where the money is.” When people become willing to pay more for a name, a sentiment, an investment theory or a get-rick quick scheme, there’s someone more than willing to exploit that desire with everything from misleading statements to inventive fakes. Ironically, environmental, social, and governance (ESG) investments have become a prime example.

Stagflation and Why It has Economists Worried

On a theoretical basis, stagflation should not happen. In a normal market economy, slow growth prevents inflation. Consumer demand drops enough to keep prices from rising. The developing theory after the 1970s was that stagflation can only occur if government policies disrupt normal market functioning.

Is stagflation possible in today’s economy? No one really knows.

Replacing “Retirement” with the Goal of “Financial Independence”

Covid and the pandemic lockdowns gave a lot of people a chance to stop and question what they wanted out of life in the long run. For many, the answer wasn’t years of work with retirement when Social Security payments become available, but rather the financial independence to live a more meaningful life. Instead of working to build retirement savings, their plan changed to building financial independence to live the way they want now.

Inflation is Changing the Numbers for Benefits and Federal Taxes

Inflation is making itself felt in more than daily prices. The Social Security Administration has reported that approximately 70 million Americans will see a 5.9% increase in their Social Security benefits and Supplemental Security Income (SSI) payments in 2022 as cost-of-living increases.

The IRS is not as generous in its increases, which take effect with the 2022 tax year. While the pending “Build Back Better” legislation, with its slew of tax increases, may change the following, so far the IRS is planning on ….

Hide Your Home Online!

Every time you give a hotel clerk, merchant, online seller, or raffle organizer your home address you also give them the ability to see exactly where you live through street-level 360º photos available on Google Maps and competing mapping services. Sometimes that’s a little too much information, and definitely more information than they need.

The good news is you can hide your home on the online mapping services.

Fourth Quarter 2021 Articles

Time In the Market Is Essential for Investment Success

Investing is about managing the risks that will substantially reduce your ability to “stay in the game long enough” to “win.”

Lance Roberts

The first reality of investing is that financial markets are volatile. The second reality is that it is hard to outperform the buy-and-hold return of the S&P 500 index.

So why not just invest in a S&P 500 index fund and walk away for the next 20-30 years?

The problem is that no one knows how much will be lost in a market decline, how long the decline will last or how much time it will take to recover. Every bear market takes place in unique circumstances.

Updating Your Retirement Plan Beneficiaries Matters More Than Ever

Given the last year and a half, you want to make certain your designated beneficiaries are still alive and that there have not been changes in marital status or new babies that you need to take into consideration. Equally important, you need to realize the rules for withdrawing funds from an inherited IRA have changed for non-spouse beneficiaries.

Advice for Gen Y and Z:

Rule #1: Pay Yourself First

Creating financial security, having the resources to weather a disaster, purchase a home, get out of debt, fund a new business, pay for a child’s education, and so much more, starts with a simple step – pay yourself first.

Living With Inflation

Like it or not, inflation is with us. It may be transitory, but more and more, inflation looks like a multi-year companion. And when it comes to the cost of living, what goes up rarely comes down again. The trick is to learn how to live with inflation without having it destroy your lifestyle.

Third Quarter 2021 Articles

When Forecasts are Bearish and Bullish….

Which way is the market headed for the second half of 2021?

There are plenty of opinions on both the bull and bear sides of the coin. Bears see an overpriced market, inflation and a threatening recession with growth stalling out. Bulls, however, see opportunity for the economy rebounding post-pandemic with a resurgence of buying, government spending, and an explosion in innovation and entrepreneurship.

A tremendous amount of energy and intelligence goes into trying to rationalize financial markets. But in the end, stocks will go up as long as people want to buy them.

The Coming Tax Tsunami

President Biden came into office with a very expensive agenda. Making that agenda a reality requires finding the money to pay for it. And therein lies what are arguably the most aggressive tax proposals since the Revenue Act of 1942.

To Live Longer, Be Happy

After a year like 2020, it’s important to step back and remember that happy people live longer and have healthier lives. How can we be happier? Before you spend a fortune on psychotherapy trying to figure out why you are unhappy, try to act like an extrovert for one week.

Bitcoin Is Not an Investment

There’s nothing wrong with taking a flyer on a cryptocurrency, but before you do so, you need to understand that you are not investing, you are speculating. You are buying an asset with no capacity to generate income or produce growth. You could lose all or much of your money. Cryptocurrency is trip to Las Vegas where no one knows the odds.

Lessons from a Pandemic Year

For many, the past year is one best forgotten. But it was also a period of new perspectives, discovery, technological advances, and changes that promise to impact the future. Before we write off the period as a very bad, no good year, it helps to look at some of the positives.

Online Shopping Increased in 2020; So Did Online Scams

Online purchase scams boomed during the pandemic as more people bought items online. According to the Better Business Bureau Scam Tracker Risk Report, nearly 40% of Scam Tracker reports were about online purchases. More than 80% of consumers reporting these scams lost money – on average $93, but sometimes thousands of dollars. How can you avoid online scams? This article explores some precautions all online buyers should follow.

Second Quarter 2021 Articles

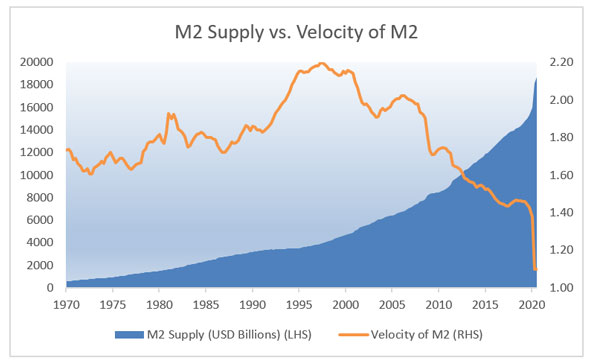

In 2020, the amount of money in the U.S. economy increased by more than $4 trillion, a one-year increase of more than 26% in M2 – a measure of the money supply that includes cash, checking deposits, and easily convertible near money. Another $2.3 trillion (12%) increase is already built into the Federal Reserve planning for 2021.

That’s a lot of money. The problem with “created” money is that it all too often ends up producing inflation..

2020 left homeowners with a number of reasons to cash out on the appreciation in their home. One reason might be to take advantage of a tax break for homeowners included in the 1997 Taxpayer Relief Act before it has a chance to disappear.

Over the past year, the email IN box has become an even greater minefield of threats to your financial welfare. Where do you start with protecting yourself from fraud? This article offers four essential steps, including how to verify the sender before opening an email or clicking any links.read more…

Maximize Your Retirement Plan Contributions for 2020 and 2021

The article shows the maximum individual/employee retirement plan contributions allowed by the IRS in 2020 and 2021, with the exception of the SEP IRA where the company contribution limit is shown. While contribution limits are largely similar among the different plan types, there are limitations as to who can and cannot contribute or deduct contributions based on income levels or participation in employer-sponsored plans. Employer-sponsored plans may have different contribution limitations.

First Quarter 2021 Articles

Feeling a bit shell-shocked by the passage of 2020? Between Covid 19, record-breaking forest fires, hurricanes, tornadoes, riots, and political turmoil, 2020 was either one to remember or one you would really like to forget. Unfortunately, many of the problems of 2020 still continue, but there are steps you can take to have a sense of control over your life.

When it comes to surviving down markets or bad investments, there’s a lot to learn from how and why some people survive major disasters while others perish. Every crisis – whether a financial or physical disaster – produces two types of people – survivors and victims. The difference can be a matter of luck, but more often imagination and preparation play a role.

We’ve been given another year. Let’s not waste it thinking about the opportunities and plans that we had to forgo in 2020. The New Year is an unwritten book. It may be another difficult year, but it is also 365 days we can use to achieve long-term goals.

Is there something you have always wanted to accomplish? A book to write? Relationships to rekindle? Inventions or products to develop? Artwork? Remodeling? A new business?

When Family and Friends Ask for Money

Thanks to the pandemic, many people are in a world of hurt and those who aren’t may find themselves besieged with requests for financial help. But before you make loans to family and friends, or donations to non-profits with a heart-rending appeal, ask yourself if you are putting your own financial health in danger, especially if you’re close to retirement.

According to the Federal Trade Commission, nearly 75% of loans made to family and friends are never repaid…

Fourth Quarter 2020 Articles

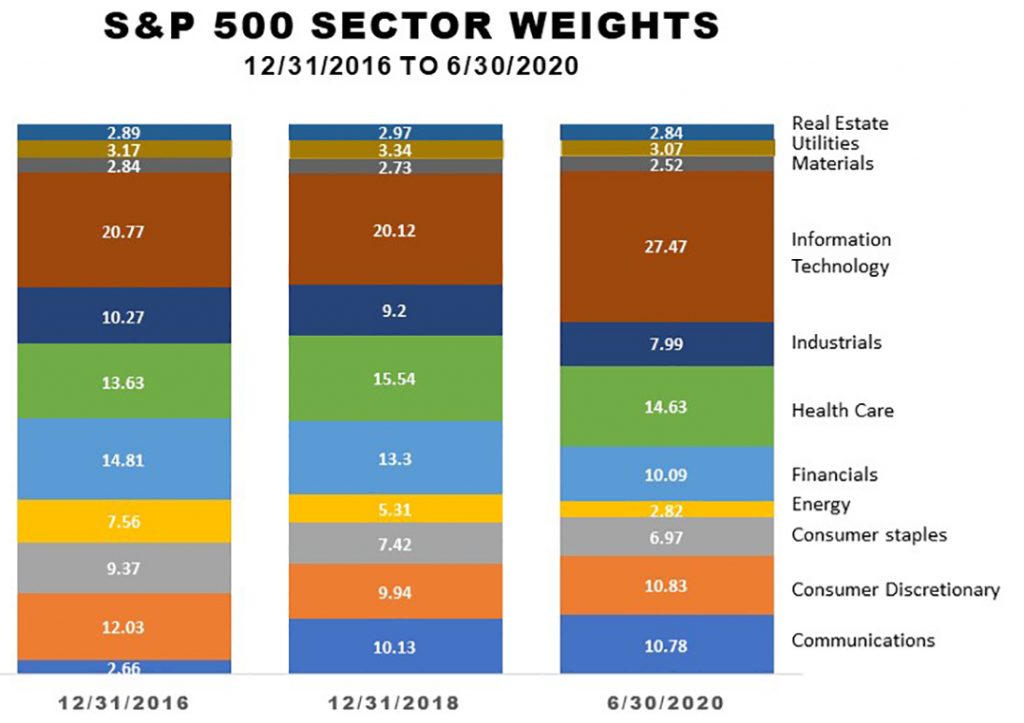

The S&P 500 Index had a great summer in 2020. Business news reports were full of rallies, record up days, and economic recovery. But before you use the S&P 500 as an indicator of the health of the economy or even the performance of the equity markets as a whole, it helps to understand what, exactly, the S&P 500 is. The S&P 500 Index is a weighted measurement of the performance of the 500 largest publicly traded U.S. companies. Although 500 stocks are included in the index, just five stocks (1% of the companies that make up the S&P 500) currently account for more than 25% of the index. In just four years, the Information Technology sector has grown by 32% to represent 27.47% of the S&P 500 Index’s value, while the Energy, Financials, Industrials, Consumer Staples and Consumer Discretionary sectors have led declines in sector weight.

It’s difficult to invest without believing in cycles. From business cycles and product cycles to stock market cycles, there is a tendency for patterns to repeat in variations on the theme over time. In his most recent book, The Storm Before the Calm, geopolitical analyst George Friedman gives a new perspective to today’s political hostility, riots and turmoil. We are at the intersection of two major cycles in American history, he maintains.

Discretionary versus Non-Discretionary Management

Given market volatility, it is important for individuals to understand whether or not their financial adviser has the ability to limit drawdowns in a portfolio or to take advantage of market opportunities by repositioning assets. This typically depends on whether the adviser has discretionary or non-discretionary management authority.

Air and Water Are the Center of Better Health

The impact of coronavirus goes far beyond the potential of getting sick from Covid-19. Jokes abound about the Covid 15-pound lockdown weight gain. More serious, a tracking poll by the Kaiser Family Foundation found that 45% of adults said the pandemic had affected their mental health. How do we re-center ourselves and get back on track to better health? Health consultant Yegene Chun recommends that you start with your breathing.

May the Power of the List Be with You

One of the best ways to take control of your life is to start with a list. On the left side, list the things you can control; on the right, the things you cannot control. The left side is where your power lies. The right is where you have to accept that you have minimal, if any, influence over some elements of your life and that it will not do any good to invest your time in worrying about them. Instead, use the left side to make plans that can adapt to or moderate the uncontrollable.

Third Quarter 2020 Articles

Modern portfolio theory, capital asset pricing theory and passive asset allocation have always had a major weakness. Determining the right asset allocation looks at the past and the relationship of asset classes and risk over time. Covid-19 has just dealt a body blow to the ability to anticipate the future based on the past. The post-Covid world will be one of change for equity markets world-wide.

CARES Act Financial Considerations

The Coronavirus Aid, Relief, and Economic Security Act included some important changes to charitable gifts, emergency withdrawals and loans from retirement accounts, deductibility of losses on taxes and even the required minimum distribution for those over 70½. This article highlights important changes that may affect you.

Perhaps the most intriguing aspect of wealth is that it is limitless. There is no fixed amount of wealth available in the world, no pie of wealth where one person’s wealth reduces another’s share. Wikipedia defines wealth as an abundance of valuable financial assets or physical possessions which can be converted into a form that can be used transactions. But that overlooks a very important characteristic of wealth – Wealth can be created.

This May Be a Good Time to Give Away Assets

The Tax Cuts and Jobs Act, enacted in December 2017, temporarily increased the Basic Exclusion Amount (BEA) from $5 million to $10 million for large gifts from estate and gift taxes for tax years 2018 through 2025. A number of concerns were raised with respect to the BEA because the higher exclusion amount reverts to pre-2018 levels at the end of 2025, barring any subsequent tax law changes. In November 2019, the Treasury Department and Internal Revenue Service issued final regulations confirming that individuals taking advantage of the increased gift and estate tax exclusion amounts in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to drop to pre-2018 levels.

Should You Convert Your Traditional IRA to a Roth IRA?

If your income is likely to take a hit in 2020 due to the coronavirus pandemic and you have a sizeable balance in a tax-deferred IRA, this may be a good year to consider a Roth IRA conversion. In some states, unemployment is not considered taxable income (make certain you understand your state’s rules), which may also help keep your taxable income low.

Second Quarter 2020 Articles

The Reality of Stock Market Declines

At the most basic level, stock market prices are a function of supply and demand. Too much supply or too little demand and prices decline. Too much demand and not enough stock to satisfy that demand will push prices up. But then it gets messy, because the factors that influence demand can defy logic. And markets can remain illogical on both the up and downside far longer than may make sense.

Time to Rethink Your Retirement Plan Strategy

December 20, 2019, the passage of the SECURE Act – Setting Every Community Up for Retirement Enhancement Act set in motion the most substantial rule changes for retirement accounts in 13 years. Designed to expand retirement plan access and increase lifetime income options in retirement plans, the SECURE Act also changed required distribution rules for retirement plans. These changes will dramatically impact estate plans for individuals with substantial IRA balances who were looking forward to providing children and grandchildren with funds for their future retirement.

Have You Set Your Account Alerts?

Financial fraud is alive and doing quite well in our increasingly digital society. It seems as soon as we anticipate one problem, a new scam springs up. While you may not be able to keep up with all the ways your accounts are threatened, you can make certain you are alerted early to any problems in your accounts. Every financial institution has their own approach to security alerts so you will need to set up each according to their procedures.

Everything you have been told about how your brain changes as you grow older may be wrong. As more people reach their senior years, researchers have started asking why many people remain highly functional into their late 90s, and the answers they are finding are changing our ideas of aging.

First Quarter 2020 Articles

Can the Equity Markets Predict Our Next President

The big surprise of the 2016 election was how poorly opinion polls predicted the results. Can the stock market do a better job? According to the results of the last 23 presidential elections, the S&P 500 has predicted the winner accurately 87% of the time.

Assessing Your Financial Security

In order to get where you want to go, you need to know where you are. Do you know what your financial resources are? Are you on track with your financial goals? Could you be impacted by proposals to increase taxes on wealthy individuals? And for that matter, are your investments under-diversified or over-diversified? The best tool you have to answer these and many more questions is a net worth statement. In this article, we provide a Net Worth form to help you calculate your net worth and better understand your current financial situation.

Relying on Pension Funds May Be Hazardous to Your Retirement

It’s no secret that many government pension funds are underfunded by a massive $5 – $8 trillion dollars. But pension plan problems don’t stop there. Many multiemployer pension funds, which are governed by collective bargaining agreements between a group of employers and a union, are also underfunded. These pension funds cover some 10 million workers and retirees, including bricklayers, musicians, miners, steelworkers, roofers and truck drivers. According to the Wall Street Journal, the most troubled plans are an estimated $100 billion short of what they need to pay out promised benefits.

Collectibles Is a Market in Transition

Buying collectibles for investment purposes has always been a tricky market, but a number of trends in today’s market makes it even harder to profit. As a result, the rule for success is buy what you love…if you are lucky some items may turn out to be valuable. Among the trends depressing the value or collectibles are…

If You Are So Smart, Why Aren’t You Rich?

Being smart is never a guarantee of riches, in fact some very smart people have a distressing habit of sabotaging their success. But there are some characteristics that can influence why individuals are unable to save and invest.

Fourth Quarter 2019 Articles

Managing Risk in Uncertain Markets Has Costs, But Creates Potential

Active management is based on one of the realities of investing that is rarely emphasized in media coverage of the financial markets – markets tend to take a step backward for every two steps forward. Preserve the value of your portfolio in declining markets, and instead of requiring gains to make up losses, you build portfolio value as the market recovers.

Staying Wealthy is a Matter of Planning

There are two sides to the wealth conundrum. The first is getting there. The second is staying there. A surprising number of people are good at getting wealthy, but not at staying wealthy. So how do you stay wealthy?

The problem with people is that we are basically nice. We want to think the best of others and we want to help those in need. Scammers and predators understand that as well. But they are not nice and they see others as sheep deserving to be fleeced. There are two key red flags that can help you avoid being the victim:

What is Your Real Risk Tolerance?

The problem is with risk “tolerance” is that your tolerance level changes over time, sometimes very quickly. When you first answered questions to determine your risk tolerance, a number of factors influenced your response from current market conditions to your mood, prior investing experience, your sex, marital status, how you view your current level of financial security, job security and more.

Withdrawal Strategies and Your Estate

If you anticipate leaving assets to your heirs when you die, which assets will make the best inheritance? Should you spend down your retirement accounts or non-tax-deferred investments first? While the correct answer will depend on your unique financial situation, one consideration is the impact of taxes.

Third Quarter 2019 Articles

Is 2019 a “Sell in May and Go Away” Summer?

Historically, the summer months have been a relatively flat period in the market. 2019 may look like a year when sell in May and go away is working, but before you take it to heart, there are a number of reasons the market could put in a respectable summer performance.

Social Security Claiming by the Numbers

When should you start to claim Social Security benefits? The answer depends on your personal situation. How long can you expect to live? What are your other resources for retirement income? What are your estate planning goals? There is also the question of your expectations for the future of Social Security. But you also need to understand the how your claiming decision will affect the income you will potentially receive from Social Security over your lifetime. The numbers matter.

Password, Password, Who Has the Password?

Planning ahead for disability, dementia or the potential of one’s death is never fun. But if you want to prevent a potential disaster for your family or estate administrators, it is essential. And one of the most important pieces of information you need to have available are online passwords. Without a system in place to pass on your passwords, life can get very complicated.

The number one regret for most people, retired or still working, comes down to five simple words – I should have saved more. So why do so few people have savings to tide them over rough patches in life?

Second Quarter 2019 Articles

Too Conservative an Investment Stance Can Also Be Risky

It’s one thing to move to cash when markets are falling, but to stubbornly remain in cash when the market’s trend turns back up needs a better reason than fear of a future loss. Sitting it out can end up costing you far more than being invested.

Have You Misplaced an Account?

There is more than $100 billion in unclaimed retirement account assets, according to the U.S. Government Accountability Office. Here are some tips for finding misplaced accounts.

Death and taxes may be inevitable, but death only comes once. Taxes are a daily part of life, particularly each April when the pain of tax return preparation is fresh in our minds. Which makes this a good time to look at how to reduce the tax bite on investment earnings.

The Tax Bite Takes A Big Part of Some Unusual Gains

Buried treasurer, stolen property, Nobel Peace Prizes, gambling winnings, fantasy sports, bartering and definitely any Bitcoin profits are all taxable. If you are selling body parts or are a young woman donating eggs to an infertile couple, any proceeds are considered income.

Put Worry to Use Developing Plans

One of the myths of money is that a lot will eliminate your worries. In reality, those with the most savings are often the ones who worry the most. There are many potential financial situations that we can’t do anything to prevent. But we can put in place plans to limit the damage and survive, and it starts with identifying your worries and whether they are productive or not.

Money Madness – Those Irrational Money Behaviors

Behavioral finance is one of the hot topics of the day. It’s all about why people make poor financial decisions. Before you consider it all “bunk” and ignore the conversation, take a look at how marketers are putting that same knowledge to work.

First Quarter 2019 Articles

Is Intuition a Liability or Asset in Investing?

Can investors trust their gut reactions or intuition in times of uncertainty? The answer is … it depends.

Most hacking exploits and computer scams rely on human error. The best virus protection software can’t help when scams rely on tricking the user. Fear, greed, sex and cluelessness are the hacker’s most important tools.

Stealth Wealth and the FIRE Movement

Today’s 20- and 30-year-olds have come up with a new movement with the potential to change life as we know it – the Financial Independence/Retire Early, or FIRE, movement. The idea is relatively simple – save like crazy so you can retire early.

Optimize Your Retirement Contributions for 2018 and 2019

Retirement account contribution limits are on the rise in 2019, with IRAs experiencing their first increase since 2013. Following are maximum amounts employees can contribute to their retirement plan in 2018 and 2019.

Turning 65 Triggers an Important Deadline

There is a very narrow window for future retirees to enroll in Medicare or face lifelong delayed enrollment penalties.

Fourth Quarter 2018 Articles

Seasonality Cycles and Fourth Quarter Returns

With September – historically the worst month for the financial market –now behind us, it’s time to look forward to the fourth quarter. While retailers anticipate strong fourth quarter sales to put their earnings solidly in the black, investors also cross their fingers and hope that the fourth quarter’s traditionally strong performance holds true for yet another year.

There’s a curious tendency among individuals to be relatively complacent about their ability to retire financially secure right up until they top age 60. Then the worries take over.

Teaching Money Smarts Needs to Start Early

For many parents, one of the greatest gifts they believe they can give their children is financial security. Unfortunately, without also giving their children money smarts, there’s no such thing as financial security. Even among America’s wealthiest families, by the second generation 70% have lost their wealth and by the third generation, only 10% of the families are still among the wealthy.

Using Transfer-on-Death Designations for Estate Planning

An older client, when asked why she did not have a will, replied that if she wrote one, she would die. And as it turns out, she isn’t the only one reluctant to deal with the idea. It’s amazing how many people leave considerable estates to the whim of the courts. The good news is you don’t have to have a will to make certain major assets go to the individuals you would like to see have them.

Time for a Review of Your Financial Situation?

At least annually, make time to sit down with your financial adviser, whether by phone or in person, and review your financial situation, changes in your life, issues that are worrying you, and where you are in achieving your goals. If you have a particular concern, reach out to us at any time.

Third Quarter 2018 Articles

Risk amnesia happens when investors forget the pain of bear markets and begin to think that this time is different.

Be Ready When You Step Out into Retirement

Has the idea of retiring been on your mind more and more? If your answer is yes, it’s time to take a hard look at your finances and find out how you can make retirement a reality.

Wire Fraud Is Becoming Increasingly Common, Particularly in Real Estate Transactions

Wire fraud has become the fastest-growing form of real estate cybercrime in the United States. Hackers access the title companies’ computers and records of upcoming home closing or intercept outgoing emails and then email fraudulent wire transfer instructions to buyers.

Five Easy Ways to Give Away Your Money

As one gets older, a curious dilemma arises – how to give away one’s money to someone other than to the government in the form of taxes. There may also be reasons to move assets out of a future estate if you anticipate disputes.

Money Can Have an Outsized Impact on Your Health

Money is a leading source of stress for Americans, according to the American Psychological Association. The curious thing about money is that it doesn’t seem to matter how much you have, you still worry about it. For most people, there is a touch (and sometimes a lot more than a touch) of irrationality as well as a lot of deep-seated emotions in our attitude toward money.

Second Quarter 2018 Articles

Every lesson of past market history tells us that the cycle from bull to bear, and repeat, is inevitable. There is something in the human psyche that pushes us to extremes, from extreme optimism to extreme pessimism; from overbought to oversold; from rise to fall of enthusiasms.

Slicing and Dicing the Financial Markets

The Dow Jones Industrials and S&P 500 Index may be the most widely known stock market indexes, but they are actually rather antiquated. The Index Industry Association surveyed their members to find out how many indexes they maintain and found out that there more than 3.2 million financial market indexes.

Looking Forward to Driverless Cars

Often the defining moment when one is no longer able to live independently is the loss of the ability to drive. Which is why the development of driverless cars opens the potential to age in one’s home without being stranded; to continue favorite activities and social interaction, with the simple words, “Home, car.”

Build Flexibility into Your Financial Life

“Life is what happens to you while you’re busy making other plans.” The one thing we can count on in the future is that there will be surprises. In financial planning, as in all aspects of our life, we must build in flexibility, i.e. the mental capacity to adjust when life happens outside of our planning zone.

2017 Tax Reform Has Made It Essential to Review Estate Plans and Wills

Most of the coverage of the Tax Cuts and Jobs Act passed in December 2017 has centered on business and individual income tax impacts. But the legislation also made some major changes in estate taxes that may require a review of your estate planning and the provisions of your will.

First Quarter 2018 Articles

Welcome to the Prediction Games

Wondering where the stock market is going in 2018? Based on prediction data collected from market forecasters since 1998 by CXO Advisory Group, market experts accurately predicted market direction 48% of the time. A coin toss would have been just as accurate.

The U.S. Stock Market is in New Territory

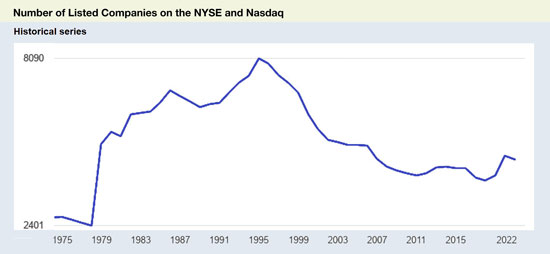

In 1996, there were 7,322 domestic public company listings. Today there are 3,671. That’s not to say that there are fewer businesses today than in 1996. In fact, the number of businesses has increased from nearly 4.7 million in 1996 to 5.9 million in 2015. But fewer are choosing to list on the stock exchanges.

Floods, Fires, and the Need to Prepare for Disaster

While there is little we can do to prevent natural disasters, we can be prepared to weather their effects intact. This article provides some basic steps to surviving a disaster.

Medicare Primer for Individuals Nearing Retirement

One of the big unknowns when it comes to planning for retirement is the cost of medical care. One resource Americans can count on – at least at this point – is Medicare. But it helps to understand what Medicare is and isn’t and its limitations.

Fourth Quarter 2017 Articles

Only by knowing a total solar eclipse is a recurring cycle, created by the predictable movement of the earth, moon and sun, does an eclipse turn into a festival. Bear markets need the perspective of knowledge as well if investors are to survive them and move on to the next phase of the market.

It’s Time to Start Thinking About Taxes

The best time to reduce the impact of taxes on your income is long before you start compiling information for filing your taxes. By the fourth quarter of the year, the countdown is on for putting effective strategies in place.

As if we didn’t have enough to worry about as we age, from medical costs to fears of outliving our money and more, it turns out there is yet another threat ahead – grumpiness.

Really big numbers are hard to conceptualize. Without perspective, data is easily distorted to tell a story that is misleading at best and outright deceptive at its worst.

Hey Millennials, Are You Eating Too Many Avocados?

Australian millionaire and real estate mogul Tim Gurner predicts that millennials will never be able to afford many of the benefits their parents enjoy from home ownership to financial security. The reason? They eat too many avocados, among other expensive habits.

Third Quarter 2017 Articles

The problem with writing a financial newsletter is that so often the topics seem to be downers – avoiding fraud, estate planning, market risk, etc. In this article, we promise nothing but good news.

read more…

The Common Yardstick of Investment Success

There’s a one-size-fits-all mentality to much of the news coverage of investing, which typically defines successful investment strategies and successful investment managers as those that “beat the market.” In reality, the success of an investment strategy is determined how well it meets the investor’s goals. While most investors would prefer higher versus lower returns over a given period, they also have a wide range of objectives that don’t necessarily include beating the market, particularly when it comes with the risk of market downturns.

read more…

One of the big unknowns bearing down on the U.S. will be the impact of underfunded state and local government pension plans. On a national basis, public pensions are short an estimated $5 trillion of the funds they need to meet future obligations according to the Actuarial Standards Board’s Pension Task Force.

read more …

The Fiduciary Standard and Its Impact

Effective June 9th, the U.S. Department of Labor imposed a fiduciary standard that requires stewards of retirement savings accounts to act in their clients’ best interest. Many elements of the 1000+ pages of regulation are currently in force; other provisions will become active in January 2018. This article provides an introduction to the standard and its impact on investors.

read more …

Combatting Financial Exploitation of Seniors

To combat financial exploitation of investment accounts of the elderly, the SEC has approved the adoption of new FINRA Rules to permit brokerage firm representatives/members to place temporary holds on disbursements of funds or securities from the accounts of specified customers where there is a reasonable belief of financial exploitation of these customers; and requiring members to make reasonable efforts to obtain the name of and contact information for a trusted contact person for a customer’s account.

read more …

Second Quarter 2017 Articles

An Updated Look at an Old Fallacy

One of the most common arguments against trying to actively position assets to take advantage of market trend is “Missing the Best.” In this approach, the supporter of passive management points out that no one is able to perfectly forecast the market and if you miss just the best 10, 20 or 40 days of the market your returns decrease dramatically.

Which makes it interesting to take an updated look at the data behind the argument.

The Pluses and Perils of a Longer Life

Before you start planning your finances around a projected average life span of 84 (men) or 86 (women) years, remember that you could be among the 50% that live much longer. About one out of every four 65-yearolds today will live past age 90, and one out of 10 will live past age 95.

…read more

Checking the Facts

The headline was quite clear – THE MISERY INDEX IS ON THE RISE. The rest of the copy explained that increases in the misery index are followed by market downturns and that investors need to move now to position their assets safely. But was the message accurate? Thanks to the Internet, we have an incredible opportunity today to check the reality of facts that media, marketers and con artists throw at us each day. Before you panic, despair or bite on a dangling worm, take a moment to check the facts. …read more

From the Movie “The Big Short”…

“The Big Short,” released in December of 2015, chronicles a small group of investors who collectively made billions off of the housing collapse in 2008. To explain complex financial transactions, the viewer encounters a model in a bubble bath, a chef, an alligator in the swimming pool and other incongruent explanations that work amazingly well.

…read more

The Number One Source of Identity Theft is Your Wallet

When it comes to identity fraud, the biggest source of information isn’t online, but in your wallet, warns crime prevention officers. Purse snatchings, pickpocketing, theft of purses from locked vehicles and robbery are the biggest sources of identity theft. While the victim may not be able to prevent the theft – and the officers urge individuals NOT to fight back or resist – they can avoid handing the thief all of their information…read more

First Quarter 2017 Articles

In Anticipation of Higher Interest Rates

On Jan. 20, 2017, Donald Trump will be sworn in as the 45th President of the United States. Two months prior, Wall Street began betting that interest rates are about to rise, with bets on U.S. short-term rates at $2.1 trillion. Expectations for a Trump presidency include a Federal Reserve that will be under pressure to raise interest rates in a way that hasn’t been seen for more than a decade. What will rising interest rates mean for investors?

…read more

Little has Changed in Retirement Account Contribution Limits

Retirement account contribution limits remain the same for 2017 with minimal adjustments in income limits for various account types. Remember to fully fund your account(s) for 2016 by April 15th and start funding your 2017 contributions as soon as possible to take advantage of compounding. …read more

Combining Active and Fundamental Investing – or Why We Invest the Way We Do

Investopedia defines investing as the act of committing money or capital to an endeavor (a business, project, real estate, etc.) with the expectation of obtaining an additional income or profit.

At its core, investing seeks opportunities where the addition of money can create value in excess of the original investment. With respect to publicly owned companies, the addition of money/capital occurs when the company makes a public offering, exchanging stock for money, or issues debt, promising to repay the money with interest. In the process, shares of the company or debt obligations are created that can be traded among investors…read more

The Improbable Success of Seasonality Trading

When it comes to active investment strategies, one of the most fascinating – if simply because it worked for many years – is seasonality trading. Seasonality trading is based on the premise that there are good days and bad days to be invested and these days can be identified by looking at historical patterns. How can such simple systems work? Wharton University Professor Donald Keim asked the same question and confirmed that there are distinct calendar-based patterns to how stocks trade. …read more

Fourth Quarter 2016 Articles

Are Minimal Returns in the Future for Equities?

With nothing but good news in recent market performance, why are an increasing number of big name firms and analysts projecting minimal returns for the stock market over the next five to ten years? At the root of their concerns is that the current market is speculation driven. For stocks to move higher – beyond the impact of pure speculation – according to fundamental valuation, they have to increase real revenues and earnings. The source of those increased earnings is the big concern. The U.S. economy has failed to achieve significant growth momentum for 10 years and the recent trend is not encouraging…read more

Passing on Assets Without a Will

Wills get a lot of attention because once they go through probate court, they become public documents. A copy is given along with a listing of all the assets of the estate to all the heirs and beneficiaries as well as the estate’s executor, lawyer, accountant and even the IRS. That’s a lot of disclosure that you may not want to happen. In which case, it’s time to look at how to die without having the majority of your assets and how you choose to dispose of them disclosed to the public or for that matter, family members and other potential heirs…read more

Metaphors of Investing

Sometimes, when investing seems to get entirely too dry and calculating, it helps to toss in a few metaphors to lighten the conversation. Black swans, castles in the sky, unicorns, witching hours and more terms have a very different meaning in the financial markets…read more

Outliving the Doomsayers … the One Constant is Change

In 1798, Thomas Robert Malthus predicted a grim future for mankind predicting famine and starvation, unless populations were controlled. Fortunately, he proved spectacularly wrong. Malthus was not the first, nor will he be the last to overlook the power of human ingenuity and technology to change the course of history. Before you accept any forecasts of impending catastrophe take a moment to consider how often the experts have failed to anticipate new technologies and how fast the world can change…read more

Third Quarter 2016 Articles

Waiting for the Recession

Recession – a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.

When it comes to investing, recessions matter. They matter a great deal. Major stock market declines have occurred during recessions. When recessions start with stocks at high valuations, the largest declines have followed. …read more

Missing the Good Old Days of 2000

The good news – Americans on the whole are feeling a lot more confident of their future than we were in 2009. For that matter, we are more confident than we have been …read more

Financial Tool #1 – The Budget

“Budgets are what separate the financially successful from the financially mediocre.” Mindy Crary

Think of a budget as a brake. To become financially successful, you have to spend less than you earn. To control our spending, most of us need some form of a brake, a reality check as to how much we actually have and how much we spend. ..read more

Age is a Matter of Perspective

The odds are we are going to be around a lot longer than prior generations. The life expectancy for women is now 81, while men will reach an average age of 76. Keep in mind those are averages. At least half of us will live longer, some quite a bit longer. Now the trick is to make those years productive and enjoyable, and it turns out there is a relatively simple way to do so…read more

A Mind is a Hard Thing to Change

Can you trust your mind? Maybe. Maybe not. It really depends.

Our natural inclination is to cling to our beliefs, particularly if recent experience has reinforced them. The problem is that when we run into something that contradicts our beliefs, our mind works to reject the conflicting information even when we know it’s true. Scientists call this cognitive dissonance…read more

Second Quarter 2016 Articles

Living with your Investments in Volatile Markets

Yo-yo markets that are up one day, down the next, continually promising gain or loss, are among the hardest to endure. To be able to stay committed to investing in volatile markets…read more

Not on My Watch – Keeping a Great Depression at Bay

Could interest rates in the U.S. go negative? If they do, the rationale may be the memory of the Great Depression…read more

Fully Fund Your Retirement Accounts for 2015 and 2016

Before April 18th, fully fund your retirement accounts for 2015, and we would recommend that you begin to fund 2016 as well. The sooner your accounts are funded, the sooner your money goes to work for you. The following table shows contribution limits for 2015 and 2016…read more

A Word to Young Investors

You have the investor’s best friends at your side – Time and Compounding. The sooner you put them to work for you, the easier it will be to build wealth…read more

Debts Can Live On After You

Toward the end, my grandfather paid for everything with a credit card, explaining that if he died, it would be like getting everything free. While great in theory…read more